My 4 Lessons on Investment 💰

Issue #61 — Learning & Investment. Maximizing Your Return on Your Cash Savings. Courage > Information.

If you like reading this, feel free to click the ❤️ button on this post so more people can discover it on Substack. 🙏

💡 Here are 3-tips to help you learn, grow, and be inspired this week!

🎓 Learn

Here are my 4 favorite lessons on Investment:

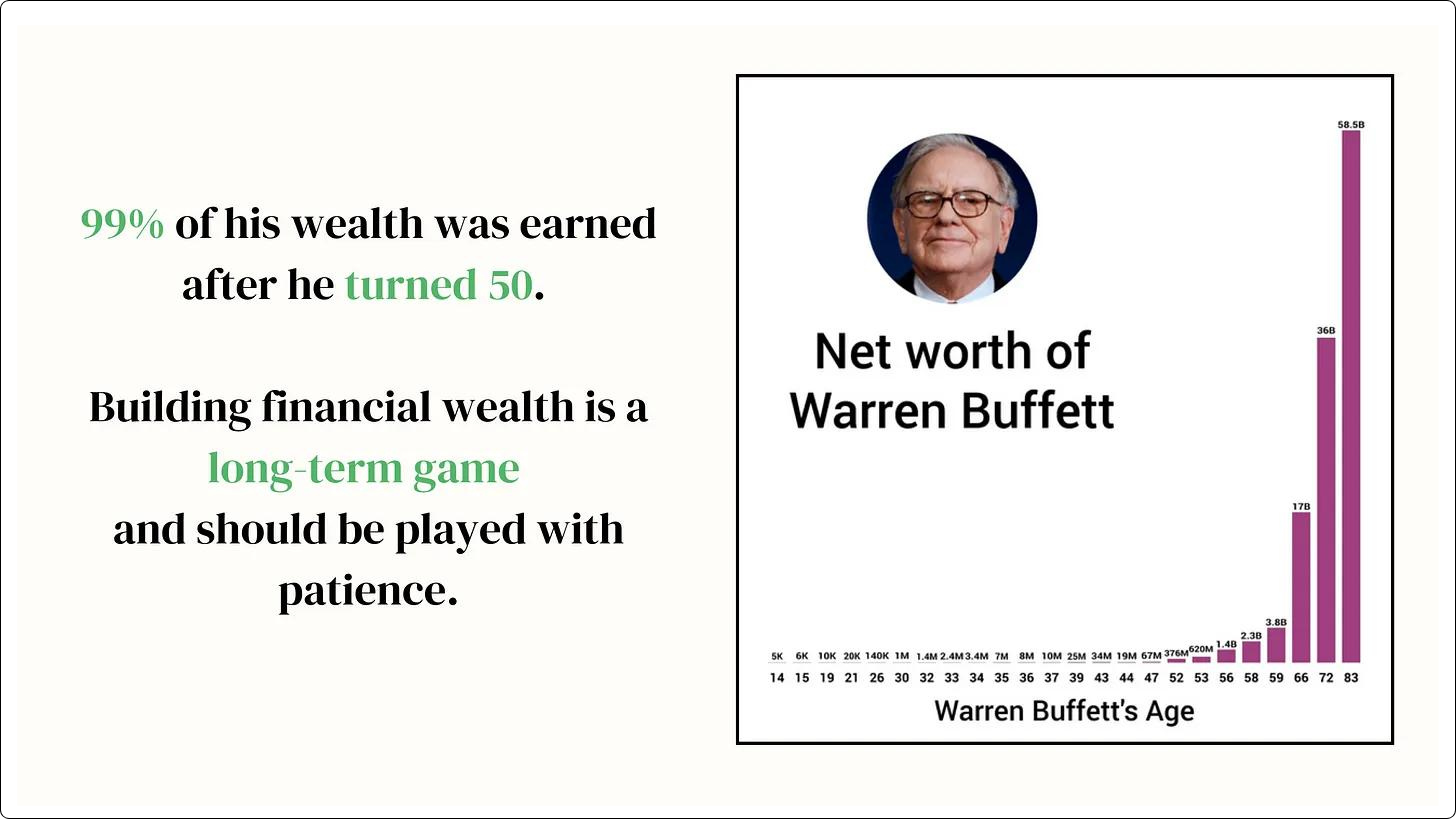

#1: Building Wealth is a Marathon, not a Sprint

Every billionaire I've studied has made long-term investments and focused on long-term returns.

This lesson has had a profound impact on me.

I used to think about small, short-term ways to build wealth, which only caused stress and anxiety.

Ironically, adopting a long-term mindset in investing has proven to be simpler, more peaceful, and more rewarding.

#2: Learning is PRICELESS

During my first job in 2005, I earned a mere $15 monthly in India. (Yes, $15, that's not a typo!)

However, those first two years of my career provided me with invaluable learning opportunities.

I wore multiple hats: taking on roles in HR, Business Development, Coding, Design, Digital Marketing, Project Management, and Solution Architecture.

These early learnings paved the way for me to become an entrepreneur.

I continued to learn every day by reading books and listening to podcasts, investing in courses to improve my skills.

Life Long Learner is one of the core values of my company and myself.

Don’t hesitate to spend on courses/programs to learn new skills.

Never think twice about buying a book.

Invest time learning from the podcasts.

Key Takeaway: Never hesitate to invest in learning.

#3: Control over spending > Controlling your investments

You have more control over your spending habits than over the outcomes of your investments.

Once you've made an investment, it's done, and you have little control over the results.

Therefore, it's crucial to focus on regularly optimizing your expenses. By doing so, you'll free up more money for future investments.

So, focus on spending less than you make and using the money wisely while allowing your investments to run on autopilot.

#4: My Best Investment to date was $50 on a Book

In 2020, I bought a book, The Snowball: Warren Buffett and the Business of Life.

This book provided valuable insights into Warren Buffett's life values and philosophy about money.

Applying the learnings from this book to my own life and business has yielded amazing returns.

Applying Warren’s investment principles gives good returns on my investments and tax savings.

Embracing the concept of a "circle of competence" has allowed me to achieve growth in my business without the cost of peace and happiness.

Leveraging the superpower of compounding has been instrumental in habit-building and investment, leading to peaceful growth.

Key Takeaway: Never underestimate the power of a good book.

🚀 Growth Tip

I use the Max My Interest website to maximize my return from my cash savings account.

My emergency cash fund is growing at the rate of 5.36% with Max My Interest, while the national average in the US is 0.45% right now (Oct 2023).

You will earn better interest on your savings with Max My Interest; otherwise, earn at a traditional “brick-and-mortar” bank and well above what most money market funds are now paying. And their savings accounts are FDIC-insured.

(Note: You can use it only if you are in the United States and have a US bank account. If you know a platform like this in your country, please share it in the comments so others can benefit.)

(Disclaimer: I don’t have any paid affiliation with Max My Interest. Also, this is not an investment advice. Please do your own due diligence.)

🤩 Inspire

In moments where I find myself procrastinating an action or decision, I visit this quote.

May the Peaceful Growth be with you! 🪴

Thank you,🙂 for sharing this.