From Poverty to Prosperity: Money Lessons I Learned From My Millionaire Journey 🤑

20 Crucial Lessons I Learned About Money From My Personal Wealth Building Journey

I want to share some valuable lessons I’ve gathered from my personal journey of achieving financial wealth.

My story starts in a challenging environment (full story here if you care) - I was born into poverty and grew up in a neighborhood marked by its struggles. Consequently, from the ages of 15 to 30, my life was fueled by a burning desire to amass significant financial wealth.

Now, let me be clear - I'm not here to dissuade you from pursuing financial success; in fact, I'm an advocate for it.

However, my approach to wealth has evolved at this stage of my life.

I'm not running towards money, but my pace has changed to walking until I achieve my "enough" number. This is my current stance, though it might change in the future.

Furthermore, it's important to recognize that we're all at different points in our wealth-building journeys.

Whether you're just starting out or have already reached your financial goals, these lessons can provide valuable insights into what it feels like to be on this path.

If you've hit your target, they can assist you in crafting more meaningful financial objectives and nurturing the right mindset for continued success.

⏰ Time & Money

#1: Know how much your HOUR is worth

Did you ever calculate your hourly rate?

It’s not how much you charge for your time, but it’s how much you make of your time.

Know your hourly rate, regardless of whether you're an entrepreneur, solopreneur, creatorpreneur, or professional.

Here is the formula to calculate:

Hourly rate = Total Annual Income / 2000 hours (Assuming you work for 8 hours a day x 5 days a week)

Once you know your hourly rate:

(Action) Outsource tasks that you don’t enjoy and can be done at a quarter of the cost of your hourly rate. → (Example) If your hourly rate is $100, consider delegating any tasks that you don’t enjoy if it costs <$25.

(Action) Prioritize your attention and energy on tasks, problems, and opportunities that are worth your time.→ (Example) If you are a business owner, focus on winning and maintaining big clients instead of obsessing over what coffee machine you need for your office. If you don’t do this, you are costing your company $75/hour.

(Action) Don’t be too obsessed about your hourly rate. → (Example)When you spend your time learning, with friends and family, helping someone, or resting.

Key Takeaway: Understanding the value of your time can guide your decisions about work and leisure.

#2: One of the best uses of money is to “Buy Back Your Time”

I always thought of money to buy things (mostly materialistic).

It wasn't until I read Dan Martell's book Buy Back Your Time that I realized the value of investing money to reclaim my time.

First, calculate your hourly rate following the formula of lesson #1. That will help you understand how much your hour is worth.

Now, here are a few examples of how you can buy back your time:

Entrepreneurs: Hire an Executive/Virtual assistant by delegating anything that’s a quarter of the cost of your hourly rate. For me, tasks like Meeting notes, Blog banners, Travel planning, etc., are not worth my hourly rate, and I’m in the process of delegating most of my tasks to an assistant.

Managers: Make a list of all the tasks that you don’t enjoy doing and that someone else can do at less than your hourly rate. And then, see if you can delegate those tasks to your team members or hire an assistant to help you. You can also buy back time by paying and using the right software and tools that save you time.

Artist: You can buy back more time to focus on creating your art by hiring a virtual assistant or using a platform like Fiverr.

Key Takeaway: Time is our most precious asset, and now I prioritize buying back more time.

#3: There's no such thing as Free; You pay with Time or Money

"Free" often comes with a hidden cost – usually your time.

It took me some time to realize that when…

I attend events just because they offer free lunch

Try a tool or software just because it’s free

Attended a webinars or event just because it’s free

… I am paying with my Time.

Knowing my hourly rate helped me assess whether investing time in these "free" offerings was worthwhile.

Key Takeaway: Be selective about how you invest your time, even when the financial cost is zero.

🥰 Happiness & Money

#4: More Money ≠ More Happiness

Money can bring happiness, but once you have enough money, acquiring more won't make you any happier!

As someone who was born poor, building financial wealth has always been one of my life goals.

At age 20, my net worth was <$100, and at 30, I became a millionaire. Did it make me happy?

Absolutely!

However, I soon realized that after reaching a certain level of financial stability, more money didn't equate to more happiness for me.

Defining what "enough" means to you is important.

It could be a specific amount of money, a set number of working hours, or a specific impact you aim to make.

Having a clear understanding of what "enough" represents allows you to know when to stop pushing for growth and start enjoying the fruits of your hard work.

Key Takeaway: Never let the quest for MORE distract you from the beauty of ENOUGH.

#5: Money Buys Convenience, but “Happiness” Requires Effort

From a spiritual perspective, "happiness" is an inherent state of being.

Yet, many of us need to exert some effort to truly feel "happy."

I would spend money and time going to new cafes, experiences, and places. Then, instead of enjoying and embracing these new experiences, I would distract myself with work, talking on the phone, or listening to podcasts and audiobooks.

Now, I try to immerse myself in new experiences and feel the joy of being in that place for the first few minutes.

Key Takeaway: While money can afford new experiences, it's up to us to fully immerse ourselves and derive joy from these experiences.

#6: If your EXPECTATIONS Grow Faster than Your Money, You will NEVER be Happy with the Money

In our fast-paced world, it's easy for expectations to outpace financial growth, leading to perpetual dissatisfaction with money.

To break free from this cycle, we should:

Set realistic financial goals.

Practice gratitude for what we have.

Live within our means.

Prioritize our values.

Find joy in simplicity.

Key Takeaway: True happiness comes from aligning expectations with financial reality and finding fulfillment in various aspects of life, not just material wealth.

#7: Money Can Buy Double Happiness

Though this lesson sounds contradictory to previous lessons, there is a profound and distinct message here. Stay with me!

Buying things for myself brings temporary joy that quickly fades.

But when I buy gifts for others, especially those who desire but can't afford them, the joy experienced is two-fold: theirs and mine.

It's like I'm buying double happiness that lasts for a long time with the same amount of money. Doesn't that sound like a great deal?

Remember, when you give, you're not just creating happiness for others but also for yourself.

Key Takeaway: The joy of giving is 2x.

👯 Relationship & Money

#8: Good Friendship can’t be bought with Money, only Earned

Good friendship, unlike material possessions, cannot be bought; it's something to be earned and cherished.

The wealth of a strong friendship far outweighs financial wealth.

Spend genuine and quality time to nurture your friendships.

Be available for your friends when they need you, not when you are available.

Money can’t be a substitute for kind and loving care.

I'm very blessed to have a few great friends like Kaushik Baroliya, Aslam Multani, Jeremy Fremont, and Colleen. 🙏

Key Takeaway: Build and maintain your "Friendship Wealth."

#9: When you receive something valuable for free from someone, make an effort to return the favor

I've learned and been inspired by numerous individuals online and offline.

Still, I had only sometimes taken the time to acknowledge them for their efforts in creating and sharing valuable content.

Now, I make a conscious effort to leave comments, like and share their work, and mention them in my newsletter if their video, blog, or newsletter has helped me learn something new.

Key Takeaway: It's important to recognize the effort people put into creating free content that helps or inspires you.

#10: If someone doesn't pay you back, they probably need it more

I have lent money and possessions to friends and family, most of whom have returned them.

However, a few didn't.

Instead of resenting them, I remind myself that their financial situation might be more desperate, and they may need that money more than me.

Key Takeaway: Instead of harboring resentment, try empathy. It may not get your money back, but it'll give you peace of mind.

#11: In your relationship with money, check who is the MASTER

Money is a powerful force that impacts our lives in significant ways.

However, it's essential to consider the dynamics of our relationship with money.

Are we the master, or does money control us?

It’s worth asking these questions to find out if you are in control:

Can you comfortably donate some money to your favorite charity or cause?

Can you buy meaningful gifts for others with your money?

Can you give money to help a friend, relative, or stranger in desperate need?

Key Takeaway: When you feel like Money has way too much power in your life, try to take back the control.

#12: The best gift I ever received only cost $3

In 2019, as I moved from India to the USA, one of my team members gifted me a $3 book called The 5 AM Club: Own Your Morning Elevate Your Life.

This book inspired me to establish a growth routine.

As a result, I developed several new habits, such as meditation, reading books, practicing yoga, and napping, which helped me achieve a balanced life.

To this day, I consider this book one of the most remarkable and life-changing gifts I have received.

(Thank you, Shailesh Patel, for such an incredible gift of wisdom!)

Key Takeaway: Books are inexpensive yet invaluable gifts.

💰Investment & Money

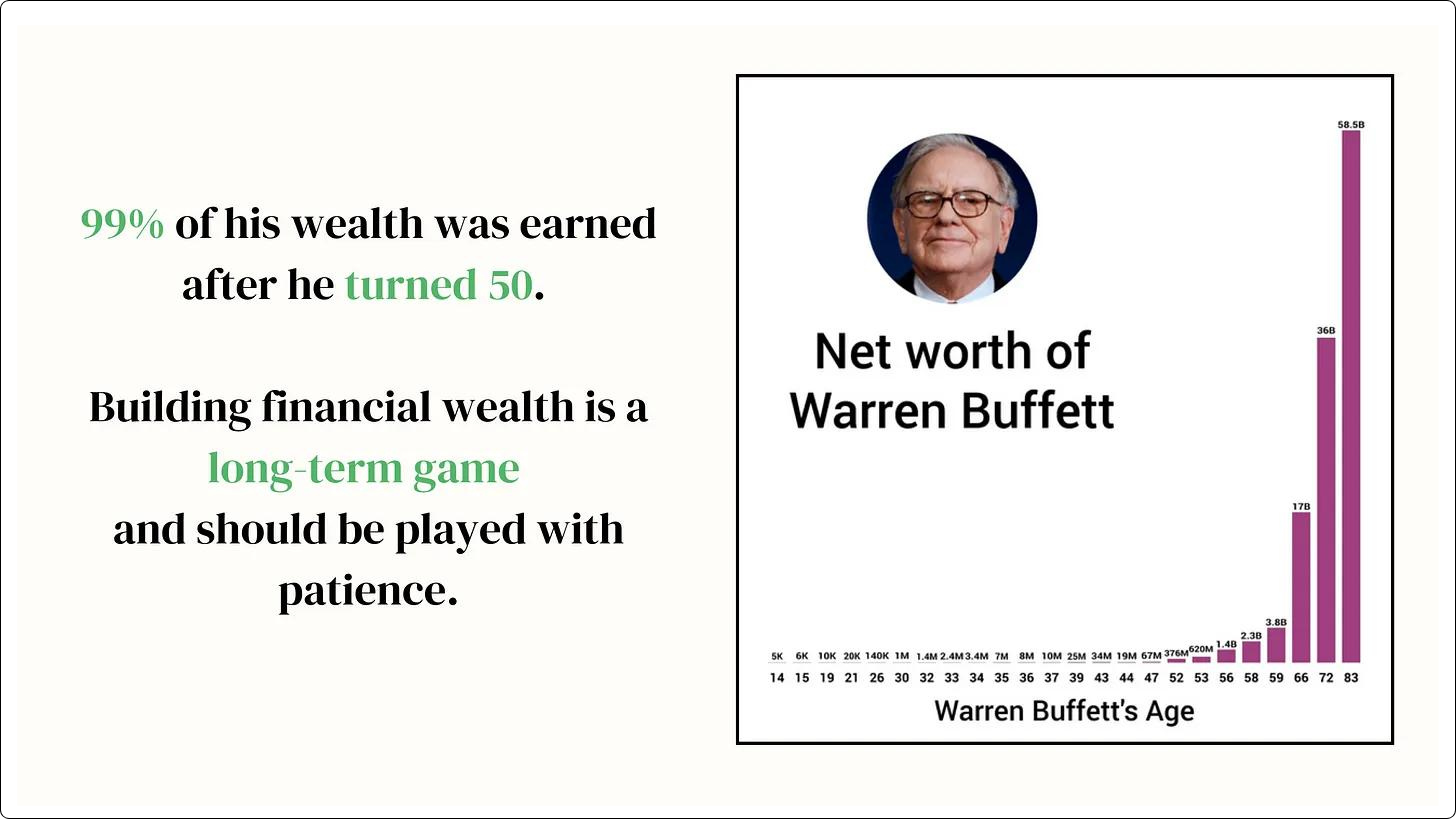

#13: Building Wealth is a Marathon, not a Sprint

Every billionaire I've studied has made long-term investments and focused on long-term returns.

This lesson has had a profound impact on me.

I used to think about small, short-term ways to build wealth, which only caused stress and anxiety.

Ironically, adopting a long-term mindset in investing has proven to be simpler, more peaceful, and more rewarding.

#14: Learning is PRICELESS

During my first job in 2005, I earned a mere $15 monthly in India. (Yes, $15, that's not a typo!)

However, those first two years of my career provided me with invaluable learning opportunities.

I wore multiple hats: taking on roles in HR, Business Development, Coding, Design, Digital Marketing, Project Management, and Solution Architecture.

These early learnings paved the way for me to become an entrepreneur.

I continued to learn every day by reading books, listening to podcasts, and investing in courses to improve my skills.

Life Long Learner is one of the core values of my company and myself.

Don’t hesitate to spend on courses/programs to learn new skills.

Never think twice about buying a book.

Invest time learning from the podcasts.

Key Takeaway: Never hesitate to invest in learning.

#15: Control over spending > Controlling your investments

You have more control over your spending habits than over the outcomes of your investments.

Once you've made an investment, it's done, and you have little control over the results.

Therefore, it's crucial to focus on regularly optimizing your expenses. By doing so, you'll free up more money for future investments.

So, focus on spending less than you make and using the money wisely while allowing your investments to run on autopilot.

#16: My Best Investment to date was $50 on a Book

In 2020, I bought a book, The Snowball: Warren Buffett and the Business of Life.

This book provided valuable insights into Warren Buffett's life values and philosophy about money.

Applying the learnings from this book to my own life and business has yielded amazing returns.

Applying Warren’s investment principles gives good returns on my investments and tax savings.

Embracing the concept of a "circle of competence" has allowed me to achieve growth in my business without the cost of peace and happiness.

Leveraging the superpower of compounding has been instrumental in habit-building and investment, leading to peaceful growth.

Key Takeaway: Never underestimate the power of a good book.

🧘🏾♂️ Peace & Money

#17: Celebrate the Journey

When I was 20 years old, my net worth was less than $100.

At age:

23 → $1,000+

25 → $10,000+

27 → $100,000+

30 → $1,00,000+

At 30, when my total net worth crossed a million dollars, I was proud and excited.

But I was even more excited about my journey to my first million, not the million itself. While becoming a millionaire can be an exciting goal, the most rewarding aspect is the journey toward it.

The process of earning my first million, the knowledge I gained, the people I met, and the person I became in the process are what truly matters to me now.

Key Takeaway: Focus on your goal but don’t forget to enjoy and celebrate the struggle and people who are with you on this journey!

#18: No Amount of Money is EVER Worth Trading for Your Peace of Mind

Don’t let money rule your health, happiness, and peace of mind.

Pay attention to early signs of stress, anxiety, and sleepless nights costs by a quest to make more money.

Money is helpful and important, but it will not make you any more happier once you have enough (Lesson #4).

I’ll choose “peace” over “money” any time of the day!

“Money often costs too much.” - Ralph Waldo Emerson

#19: It's Important to Remember What Once Seemed like a lot of MONEY to You

In 2007, I was earning only $60 per month in India.

Buying a 30-cent (25 Rs.) meal felt like a luxury at the time.

Back then, having $1,000 felt like a dream and substantial wealth.

Today, my net worth is over a million dollars.

Reflecting on the fact that 30 cents used to feel like a lot of money is humbling and keeps me grounded.

What amount of money seemed substantial to you in the past?

#20: There Are Other Types of Important Wealths to Build Besides Financial Wealth

Relationship Wealth

Intellectual Wealth

Experience Wealth

Spiritual Wealth

Energy Wealth

Health Wealth

Impact Wealth

Social Wealth

Peace Wealth

Time Wealth

Key Takeaway: These types of wealth often provide more satisfaction and happiness than financial wealth alone.

[On a different note, here’s something I’m excited to share to help you boost your productivity and performance through better writing in 2025]

How Samir, an Engineer, Transformed His Career with One Skill

Samir wasn’t a writer. He was a software engineer, great at building things but struggled when it came to explaining ideas, pitching projects, or sharing updates.

After being passed over for a promotion, he realized something: It wasn’t his technical skills holding him back—it was his writing.

He signed up for a copywriting course, thinking it would help him write better emails. (It did that and more.)

In a few months, Samir’s emails were clear and persuasive. His project proposals got approved faster. He became the go-to person for internal presentations. And, yes—he finally got that promotion.

Why? Because writing is a meta-skill.

Whether you’re an engineer, designer, accountant, or manager, writing impacts everything. Emails, reports, pitches, presentations—good writing makes you more productive, more effective, and more valuable.

Here’s the good news: WRITING IS A SKILL. You don’t “have it”, you learn it.

If you can improve only one skill in 2025, make it writing.

I’ve spent over $5,000 on different writing courses, and out of all of them, I highly recommend CopyThat—an email-based copywriting course you can complete in just 30 minutes a day for 10 days.

✍🏻 Check it out here: CopyThat

Please share any money lessons or questions you have on your journey of wealth building in the comment below.